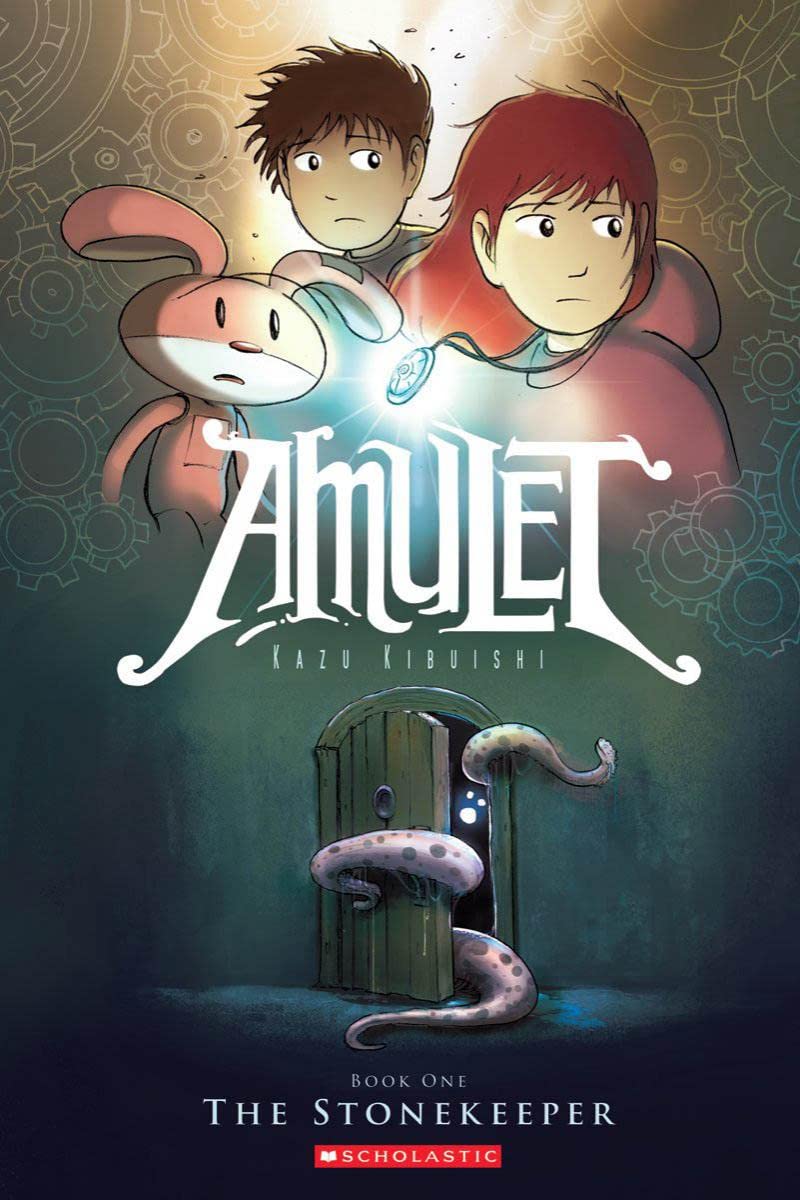

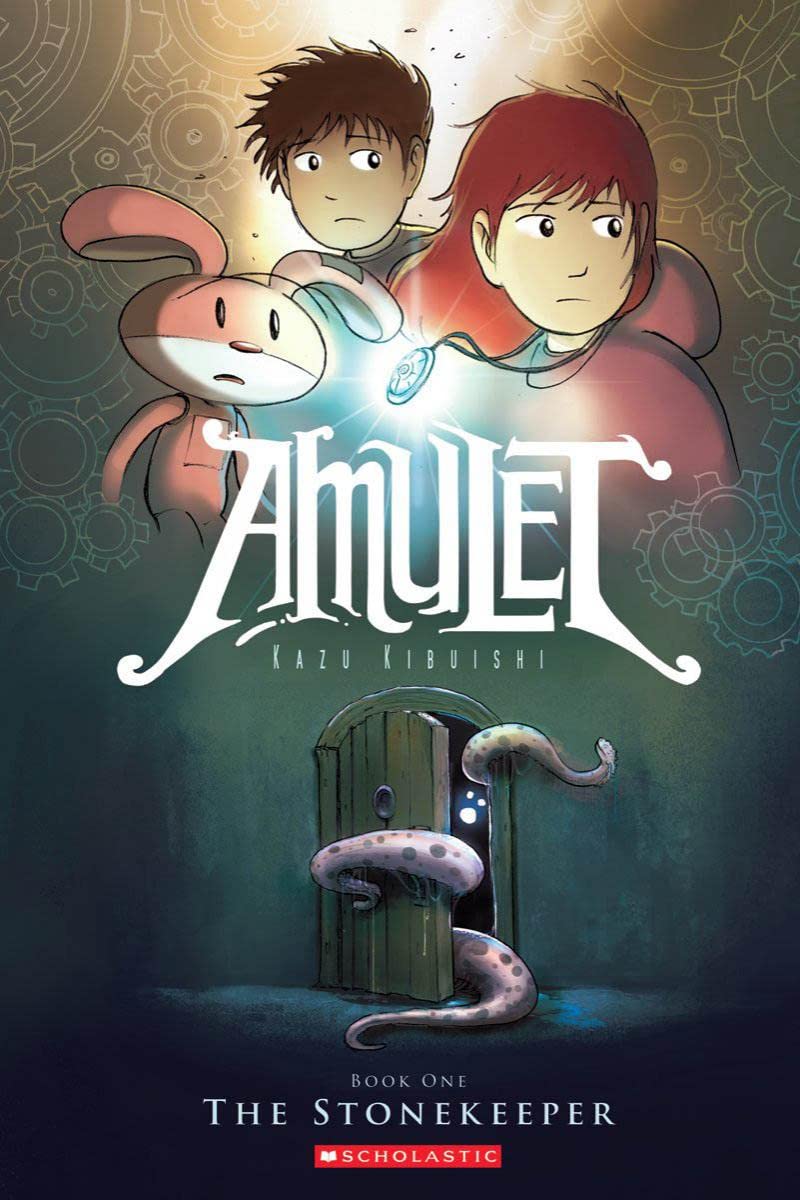

Amulet: the stonekeeper: Stonekeeper: Volume 1

FREE Shipping

Amulet: the stonekeeper: Stonekeeper: Volume 1

- Brand: Unbranded

Description

Emily Hayes (エミリー・ヘイズ Emily Hayes) is the main protagonist of Kazu Kibuishi's graphic novel series Amulet. In the series, she is a Stonekeeper, a leading member of the Resistance and Guardian Council, and, as of The Cloud Searchers, best friends and partners with Prince Trellis. She is the daughter of Karen and David Hayes, the great-granddaughter of Silas Charnon, the older sister of Navin Hayes, and the future mother of Moze. Trellis is the son of the Elf King and younger brother of Luger, as well as a stonekeeper and intended successor to the throne of Gulfen. After failing to capture Emily and having his act of interception at Gondoa Mountain seen as treason, Trellis and his brother Luger abandon the Elf King, eventually joining Emily and the Resistance after Emily defends them from the Elf King's soldiers.

Amulet books : Kazu kibuishi : Free Download, Borrow, and Amulet books : Kazu kibuishi : Free Download, Borrow, and

Throughout the series, we learn about Emily’s family’s past, her great-grandfather’s abrupt disappearance, and the power of the Amulet. Emily and Navin, with the help of extraordinary supporting characters, also learn about their own powers — powers to cope, powers to survive, powers to protect others, and powers to grow. Over the course of the series, we frequently question the motivations of Trellis and of Max. Discuss why Kibuishi has us question their motives, and discuss how Kibuishi creates these ambiguities.Social Studies: In Book Four: The Last Council (p. 81), Vigo recounts how Silas criticized the Council for making decisions based on its fears. Discuss how political and social decisions are made and why making decisions from fears may or may not be the best way to legislate. Silas's old helper robots determine that Karen was poisoned and needs an antidote, but the nearest city is 300 miles away. To take her to the city as soon as possible, the robots cause the entire house to be transformed into a giant robot. The giant robot, with everyone inside, walks through the water surrounding Silas's house, climbs out of the hole to the surface and starts walking across the landscape to the city, leading them to the antidote. While the Stonekeepers mostly benefit from keeping one, it isn't rare that they may lose control and ultimately become unbalanced. In one particular incident, several Stonekeepers were possessed by their stones and transformed into colossal beasts, which subsequently wreaked havoc on Alledia. As soon as the trio arrives in Charnon House, the figure takes his disguise and reveals himself as Miskit, a small pink rabbit robot. Miskit goes on to explain Emily's reason for having been brought to Alledia while passing by the other household robots. They introduce Emily to Silas, where she gets to speak to him for the first and last time before he passes away after explaining the decision that Emily must make; discard the stone that she had found or gained its great power that can help save her mother, but with a great price. After Silas passes the house and the robots shut down after urging her to make the right choice. While Navin remains apprehensive about the stone, Emily is ultimately convinced by the Voice to choose the stone, reactivating the house and the visibly relieved robots. Comprehension and collaboration: Prepare for and participate effectively in a range of conversations and collaborations with diverse partners, building on others’ ideas and expressing their own clearly and persuasively; integrate and evaluate information presented in diverse media and formats, including visually, quantitatively and orally; evaluate a speaker’s point of view, reasoning, and use of evidence and rhetoric.

Amulet: The Stonekeeper: Book One by Kazu Kibuishi - review

Craft and structure: Interpreting words and phrases as they are used in a text, including determining technical, connotative, and figurative meanings and analyzing how specific word choices shape meaning or tone; analyzing the structure of texts, including how specific sentences, paragraphs and larger portions of the text relate to each other and the whole; Assessing how point of view or purpose shapes the content and style of a text.In Book Two: The Stonekeeper’s Curse (p. 125), Leon tells Emily and Navin why he’s helping them: “I am not motivated by vengeance. I do this to honor him.” What does Leon mean by this? How does Leon’s helping Emily and Navin help honor his father? https://www.youtube.com/watch?v=9jA-jMpccRU (Part 1) — Watch a video interview with Kazu Kibuishi on the art of graphic novels (sponsored by Illustration.org). Learn how students have influenced the course and feel of Amulet. Jaafar, Ali (June 20, 2016). "Aron Eli Coleite Tapped By Fox To Adapt Iconic American Graphic Novel 'Amulet' ". Deadline . Retrieved July 12, 2017. Chart and analyze and discuss how Kibuishi uses color, font, and design to separate scenes. Discuss the effectiveness of these visual cues. Outer-space flight: Emily Hayes is presumably the first stonekeeper to perform this technique. It's also a combination of a bubble and psychokinesis, combined with extremely immense/colossal hyper-speed and so much more air than a bubble.

The Stonekeeper: Amulet, Book 1 - Common Sense Media The Stonekeeper: Amulet, Book 1 - Common Sense Media

Karp, Jesse (2012). Graphic Novels in Your School Library. Chicago: American Library Association. pp.70–71. ISBN 978-0-8389-1089-4.Emily shared a very contented and loving relationship with her father. Even up until the current books, after the car accident which led to his death, the anguish seems to still weigh rather heavily on Emily's mind, altering her outlook on life and causing her to become generally more solemn and reclusive. While unfortunate, David's death seems to have initiated an important and close bond between Emily, her mother and brother. Emily's determination to curing her mother after she is poisoned by an arachnopod was heavily driven by the fact that she is not prepared to lose yet another person she loves. Like most elves, Trellis has grey skin, but with a lighter skin tone. He is shown to have long white hair, and in the beginning of the series had sharp teeth, but that was removed after the fifth book. He has a long stitched up scar on his left eye, which was given to him by his father when he was slapped as a child. In Book Three: The Cloud Searchers (p. 145), Mom tells Emily that, “If you can find the confidence to trust yourself, you can make it through any situation, no matter how bad things seem.” Discuss how confidence can help you through situations. Give specific examples.

Amulet – Comic Book Legal Using Graphic Novels in Education: Amulet – Comic Book Legal

In book 8, Vigo asks Riva Ash to help lead the elves as the responsibilities will be overwhelming for Trellis so they both have to help. Vincent Janoski (August 26, 2008). "The Geekly Reader: Amulet by Kazu Kibuishi". Wired . Retrieved February 26, 2011.Amulet is a fantastic read for all ages. I just couldn't stop reading it and was so in love with it that I continued on through the current books. Social Studies: In Book Four: The Last Council (p. 38-39), Karen tells Emily that almost everywhere you go in life, “…you’re going to find something wrong with the place. That’s the way life is… You just have to be willing to follow their systems and do what you can to make things right.” Discuss how different systems of government do and do not encourage and empower their citizens to “make things right.” While initially seeing Navin as quite a bit of an immature younger brother, as shown when she is reluctant to allow him to pilot the Luna Moth, [5] she seems to develop a deeper respect for him after witnessing his technological and leadership skills. Due to the responsibilities imposed on them after entering Alledia, both siblings develop not only in their overall maturity but in their relationship and willingness to work together as well. During the various occasions Emily and Navin are separated while in Alledia, they worry about each other's safety often and even embrace whenever reunited. Navin is an amazing pilot and can be seen keeping everyone out of danger with his skills. This post takes a closer look at the Amulet series by Kazu Kibuishi. The ninth and final volume is expected to be published in 2021. This guide was written after the first six books had been published.

- Fruugo ID: 258392218-563234582

- EAN: 764486781913

-

Sold by: Fruugo